Are you ready with your million-dollar business idea but lack important resources to bring it to life? Are you skeptical in pitching your business idea to some deep-pocketed investors who will be ready to pour you in with immediate cash flow? Well, this is where crowdfunding sites come into play.

Crowdfunding has deep roots in time which go as far as the 1700s which was called Traditional funding back then. The only difference is that nowadays it has become fairly easy to crowdfund your way to a successful business.

Contents

Business Crowdfunding

Crowdfunding is a way for small businesses or startups to raise money in exchange for equity, rewards, debt, or nothing at all. Business crowdfunding can provide you with fast access to cash, but it requires a strong promotional strategy, increased transparency, and the possibility of giving up a piece of your business.

However, you can get funding by using various crowdfunding platforms for small businesses and entrepreneurs.

Different crowdfunding sites may have different features, payment gateways, and dashboards but the concept for each is the same; to get the funds through the campaign by using social media.

There are numerous sites which help you to raise funds to fuel your project and to your aid, we have listed down 10 best crowdfunding sites for startups.

Best Crowdfunding Sites For Startups

1. Kickstarter

Kickstarter is the most popular Crowdfunding platform in the world, till date they have served 1,68,500 projects successfully.

It is a reward-based crowdfunding platform. The main objective of the platform is to bring creative projects to life by focusing on creativity and merchandising, which is why it is especially famous among tech and creative entrepreneurs.

There is no lower or upper limit on how much investment one can raise on this platform but they have an all or nothing fundraising model which means that unless your campaign is completed you will not get funds.

Commission and fee: On every successful investment = 5%

2. Indiegogo

Indiegogo is one of the biggest crowdfunding platforms, they have fueled more than 8,00,000 campaigns.

They are pretty much similar to Kickstarter as they also have a reward-based crowdfunding model and are usually inclined towards tech innovations, creative works, and community projects. One factor which sets them apart is that they don’t have an exclusive all or nothing fundraising model, so even if one could not reach their goal but they can still get a percentage of it.

They are also suitable for raising any amount of investment and they offer both fixed and flexible funding options.

The fixed option is good if you know how much money you exactly need for your business but if your funding requirement changes over time, it is better to opt for a flexible funding option.

Commission and fee: On successful investments=4%,

On flexible funding campaigns= 9%

3. GoFundMe

Gofundme has been one of the most popular fundraising platforms for social or medical causes, you must have come across one of these fundraisers on social media for emergencies and charitable causes.

GoFundMe is a donation-based crowdfunding platform, they have had many successful campaigns, including the Las Vegas Victims Fund ( $11.8 million) and the Time’s Up Legal Defense Fund ($24.2 million).

Conventional startups may not raise as much capital on GoFundMe, as it is ideal for non-profitable start-up and it is good to be mindful of its low fund acquisition rate, only one in ten campaigns ever get fully funded on the site.

Commission and fee: Go fund charges a transaction fee of 2.9% in addition to 0.25 per donation.

4. Crowdfunder

Crowdfunder is a reward-based crowdfunding platform that uses an equity-based structure with a community of 2,00,000 entrepreneurs and investors. They have raised over $150 million dollars to fuel startups from Pre-Seed to Series A.

Their investment platform allows for accredited investors only. It is suitable for creative, unique, and fascinating business ideas and ideal for startups. One of the advantages of choosing this platform is that you can raise much more money than you need.

However, one factor that you should be careful about before choosing CrowdFunder is that you will have to bear a high monthly cost with them. In exchange, Crowdfunder promises access to its network of elite accredited investors.

Commission and fee: Of successful investments= 5%

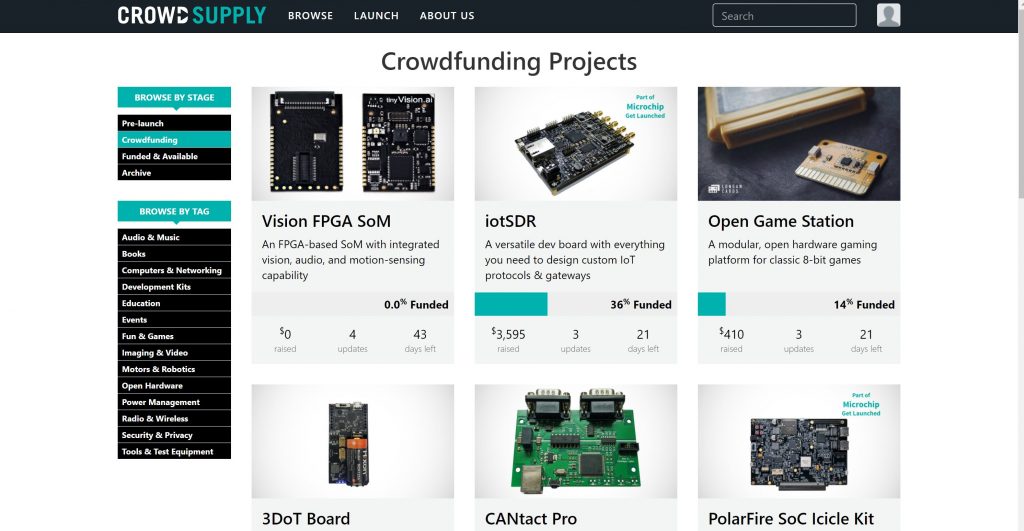

5. CrowdSupply

CrowdSupply is the best platform for product designers to raise funds.

Bring unique, useful, and respectful new hardware to them and they will help you to bring it to life. They have claimed to have over twice the success rate of Kickstarter and Indiegogo.

CrowdSupply stands out among the usual crowdfunding platforms because of two reasons mainly:

- Once the fundraising goal is met, the company offers pre-order management, warehousing, and fulfillment to help them make the transition to an operating business.

- Crowd Supply releases funds as soon as a minimum funding goal is reached, rather than at the end of a campaign.

Commission and fee: 5% of all funds raised

6. Fundable

Fundable is both a reward-based and an equity-based platform for raising funds. Unlike other platforms Fundable does not take a percentage of funds you raise rather, they charge a low, flat monthly fee. So no matter how the campaign goes monthly fee will be charged.

They also offer pretty good customer support with any queries, along with marketing campaigns, helping companies set up their fundraising profiles and sharing them with personal and professional networks.

A merit point with Fundable is that they review any company that creates a profile for their suitability before allowing them to raise money on the platform.

It is free to create a company profile and $179 per month to fundraise. There are no success fees but for rewards-based raises, there is a processing fee of 3.5% + $.30 per transaction.

7. Patreon

Patreon is the fifth-largest crowdfunding website in the world and is an extremely popular platform among the creative and entertainment industry. They are a donation and reward-based crowdfunding structure and have raised more than $350 million.

Currently, there are two million active patrons and 100,000 active creators funding their way from Patreon. They have a model for drawing a continuous flow of income for digital content creators of viral videos, online journalists, writers, and musicians.

They follow a subscription-based model in which patrons contribute a fixed amount of money every month or per creation

Commission and fee: The site offers three packages

- Lite = 5% of the monthly income earned.

- Pro = 8% of the monthly income earned.

- Premium =12% of the monthly income earned.

Payment: 5% of successfully processed payments

8. Ketto

Ketto is a very well-know crowdfunding platform in India that allows people and non-governmental organizations to raise money for their creative, social, and personal causes.

The platform includes and features campaigns for health care, startups, education, personal campaigns, sports, children and women empowerment, animal welfare, and similar causes.

Until last year, they raised 500 crores from over 1.5 Lakh campaigns and 25 Lakhs donors. Ketto also provides a section on its website called “Urgently Fund Required” and campaigns that can provide “Tax Benefit” to donors.

One of a very successful campaign was ‘The Kerala flood project’ called ‘Two Wheels of Hope’ that was featured on Ketto.

Payment: 10.62% for NGOs or 9.44% for individuals

9. CircleUp

CircleUp is an equity-based crowdfunding business, their objective is to help emerging brands and startups raise capital to water their growth.

They hold a pretty good reputation in the market as they have a huge network of entrepreneurs, experts, retailers, and investors which not only supports funding requirements but also helps in provide one-on-one guidance so that one can potentially grow their company faster.

Ever since its release in 2011, it has helped 211 entrepreneurs raise $305 million, with an average investment of $100,000.

CircleUp will charge a commission based on the total amount raised also it will depend upon your business and will be determined by CircleUp at the time you apply.

Payment: On every successful investment = 5%

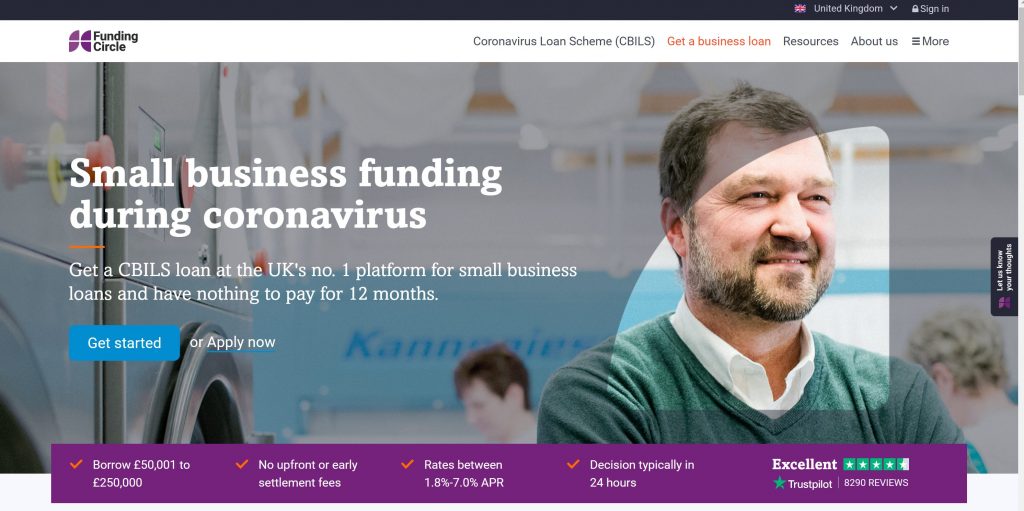

10. Funding Circle

Funding Circle is a debt crowdfunding platform; they are a popular peer to peer lending network which offers medium-term installment loans, the term may range from six months to five years.

To date, they have been able to generate more than £550 million for businesses in the UK and over $850 million for 8000 businesses worldwide.

On average one can get a loan of £60,000, but businesses can borrow up to £1 million in secured loans and £500,000 in unsecured loans.

Payment: Depends on the type of loan and its term.

Conclusion

Finally, the decision of generating funds using a crowdfunding platform is an excellent idea to inject your business with some liquidity injections. And, the next step forward in the process is choosing the type and the site of crowdfunding.

We hope that our list of top 10 best crowdfunding sites for small businesses would have helped you in some way or another.

Are your creative juices flowing? Get started with one of these crowdfunding sites today and turn your dreams into your day job.

Feel free to share your experience in the comments section below.

Also, Read:

- 10 Best Domain Registrars For Small Businesses

- 5 Point Of Sale Systems For Small Business

- 12 Best WorkFlow Management Platforms For Professionals

- 7 Must-Have Business Technology Tools To Save Time and Money